Any return for NSF not settled by the account holder within 30 days immediately attracts up to 3x the value of transaction, and becomes immediately collectable.

24-p Merchant Services

The most popular payment method for online transactions presently is Credit Cards even though this system has inherent problems of security and fraud. However, approximately 80 million US consumers do not even possess a credit card, which means that online businesses lose millions of dollars in lost sales every year because quite simply, they are unable to do business with this huge section of the consumer marketplace. In the US, the preferred non cash payment method is still the Check, demonstrating that people prefer to pay by check over credit and debit cards.

Up to now, the problem has been that online businesses have had no real alternative to offer the consumer, as credit card payment has always been considered to be the norm and simplest solution. 24-p is redefining all of the rules.

Why 24-p makes perfect sense for merchants..

Why 24-p?

How much thought have you ever really given to credit card payment schemes and what do they really mean to a merchant?

Clearly there are benefits to merchants who accept the multitude of different cards types in the course of their day to day business. With the conveniences afforded by that small piece of ready to use plastic, can there possibly be any downside? Lets explore the the real nature of credit card schemes...

The upsides:

However, did you know as a merchant you are the one who gets penalized almost exclusively, and here is how they do it:

Merchant website or Call Center captures transaction data.

24-p receives data and generates

X9.37 image (RCC).

Federal Reserve receives aggregate batch then debits account holder′s bank and credits Merchant′s bank.

In Just 5 Simple Steps

Cleared funds available in 0 - 1 days.

24-p debits merchant′s account for acquiring charges 48 hours after initial presentation of transaction.

Merchant′s Bank

Integration Methods

Both XML API and Virtual Terminal available.

Simple HTML single webpage script available.

OS Commerce module.

Refund Options

Merchant can make their own refund / rebate arrangements or 24-p can provide this service through our secure check production center. It works with any bank in the USA. API function as well as manual.

Merchants can batch upload all out-going payments which will be dispatched in physical check format on highest security check stock.

Auto Email notification of refund to clients so they know when a refund has been dispatched.

A Typical Schematic for Larger Companies

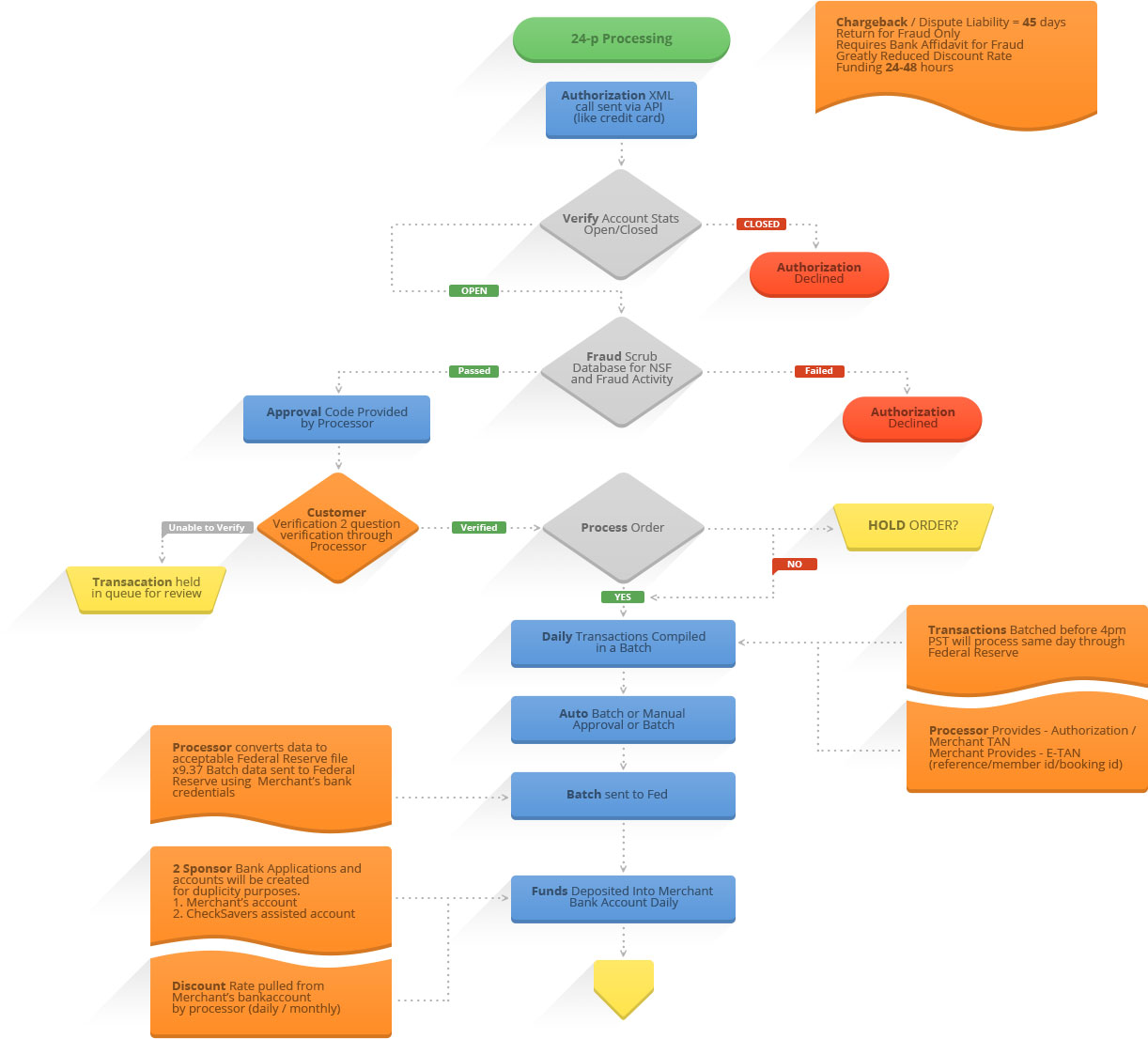

Chargeback / Dispute Liability = 45 days Return for Fraud Only Requires Bank Affidavit for Fraud Greatly Reduced Discount Rate Funding 24-48 hours

24-p Processing

Authorization XML call sent via API (like credit card)

Verify Account Stats Open/Closed

CLOSED - Authorization Declined

OPEN - Fraud Scrub Database for NSF and Fraud Activity

Failed - Authorization Declined copy 2

Passed - Approval Code Provided by Processor

Customer Verification 2 question verification through Proces

Verified - Process Order

HOLD ORDER? - NO

YES

Daily Transactions Compiled in a Batch

Transactions Batched before 4pm PST will process same day thro

Processor Provides - Authorization / Merchant TAN Merchant Pro

Auto Batch or Manual Approval or Batch

Batch sent to Fed

Processor converts data to acceptable Federal Reserve file x9.3

2 Sponsor Bank Applications and accounts will be created for

Discount Rate pulled from Merchant’s bankaccount by processor

Funds Deposited Into Merchant Bank Account Daily

Transacation held in queue for review - Unable to Verify

How much does it cost?

The model is priced as follows...

- Competitively priced transaction and discount rates to save you money.

- NO charges for declines.

- Fraud scrubbing (includes Star ATM, negative check writers database, check current open status of account, check positive balance) - From $0.15 this is priced at cost and therefore is not negotiable. This service is optional.

- Returns typically cost $15.00, made up of: - Bank's direct cost (not 24-p). - 24-p processing fee of $3.00.

- 24-p offers a FREE collection service paying 75% or more of the face value of the check to merchant upon collection.

- Transaction payment guarantee is available these are charged at a discount rate to be determined on a case by case basis. See next column.

- 24-p debits merchant’s account for acquiring charges 48 hours after initial presentation of transaction.

- Refunds cost are low. The 24-p refund mechanism is robust and can also be used as a bill pay tool.

Payment Guarantee

24-p vs Other Brands

| Check Services |

|

|

|

|

|---|---|---|---|---|

| Processing Method | Check 21 | ACH | ACH | ACH |

| Funds Deposited | o - 1 days | 3 - 7 days | 3 - 7 days | 3 - 7 days |

| Administrative Returns |

No

|

Yes

|

Yes

|

Yes

|

| Chargebacks | Limited |

Yes

|

Yes

|

Yes

|

| Business Checks |

Yes

|

No

|

No

|

No

|

| Accepted by all US Banks |

Yes

|

No

|

No

|

No

|

| Customer Data Verify |

Yes

|

Limited |

No

|

Optional/Limited |

| New user Instant Credit |

Yes

|

Limited |

No

|

No

|

| Integrated Collections |

Yes

|

Limited |

No

|

No

|

| Payment Guarantee | Optional |

No

|

No

|

Optional/Limited |

| Governing | UCC | NACHA | NACHA | NACHA |

Note: Additionally, 24-p works with 15% more checking accounts than ACH, and up to 80% more Business accounts than ACH.

Payment Scheme Comparisons

| Payment Schemes |

|

|

|

|---|---|---|---|

| Collections |

Yes

|

No

|

No

|

| Online |

Yes

|

Difficult |

Yes

|

| Project Acquiring Costs |

Yes

|

No

|

No

|

| No Chargeback Fines |

Yes

|

No

|

No

|

| No Account Termination |

Yes

|

No

|

No

|

| Minimal Chargeback Risk |

Yes

|

No

|

No

|

| Full Payment Guarantee |

*Yes

|

No

|

No

|

| Funds Deposited | 0 - 1 days | 3 - 7 days | 1 - 4 days |

| Returns Period | 30 days | 180 days | 2 years |

| Returns Supports | Merchant | Consumer | Consumer |

| Governing | UCC | NACHA | Scheme Rules |

| Returns Paperwork | Merchant | Merchant | |

| Connectivity Benefits | Direct to Federal Reserve | Bank and ACH | 2 banks and card scheme networks |

| Returns Supplied in | Less than 30 days | Up to 180 days | Up to 2 years |

Note: *Optional

What 24-p can offer your business

Top uses for 24-p Business

Paying Employees' salary (paycheck)

Businesses to Business Payments, including paying your suppliers and service providers

Scheduled payment of Insurances

Scheduled payment of Professional memberships and other subscriptions

Scheduled payment of Professional memberships and other subscriptions

Payment for Professional Business Services - Lawyers, Accountants

Airline Ticket Payment

Hotel Bills

One off Payments for large purchases

Payment of taxes